colorado paycheck calculator adp

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Colorado. Post date October 3 2019.

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide.

. Next divide this number from the annual salary. Important Note on Calculator. Find The Best Payroll Software To More Effectively Manage Process Employee Payments.

Colorado is home to Rocky Mountain National Park upscale ski resorts and a flat income tax rate of 45. Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier. Well do the math for youall you need to do is enter.

The information provided by the paycheck. Post author By James. Hourly Paycheck Calculator Loading calculator.

For example if an employee receives 500 in take-home pay this calculator can be. Overview of colorado taxes colorado is home to rocky mountain national park upscale ski resorts and a flat income tax rate of 45. Aside from state and federal taxes Centennial State.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

Secure File Pro Portal. Figure out your filing status work out your adjusted gross income. Use adps colorado paycheck calculator to calculate net take home pay for either hourly or salary employment.

Overview of Colorado Taxes. Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Colorado. For 2022 the unemployment insurance tax range is from.

Use this Colorado gross pay calculator to gross up wages based on net pay. Colorado Paycheck Calculator Adp. Gross Pay Calculator Plug in the amount of money youd like to take home.

Calculating your Colorado state income tax is similar to the steps we listed on our Federal paycheck calculator. Use This Federal Gross Pay Calculator To Gross. Important Note on Calculator.

So the tax year 2021 will start from July 01 2020 to June 30. Calculating Your Colorado State Income Tax Is Similar To The Steps We Listed On Our Federal Paycheck Calculator. Hourly Paycheck Calculator Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

Use adps colorado paycheck calculator to calculate net take home pay for either hourly or salary employment. This link calculates gross-to-net to estimate take-home pay in all 50 states. No Comments on Colorado Paycheck Calculator.

Calculate net salary and tax deductions for all 50 states in the free paycheck. The colorado salary calculator is a good calculator for calculating your total salary deductions each year this includes federal income tax rates and thresholds in 2022 and. Colorado Hourly Paycheck Calculator.

Read Your First Paycheck Jules Cents

The 10 Best Nanny Payroll Services Business Org

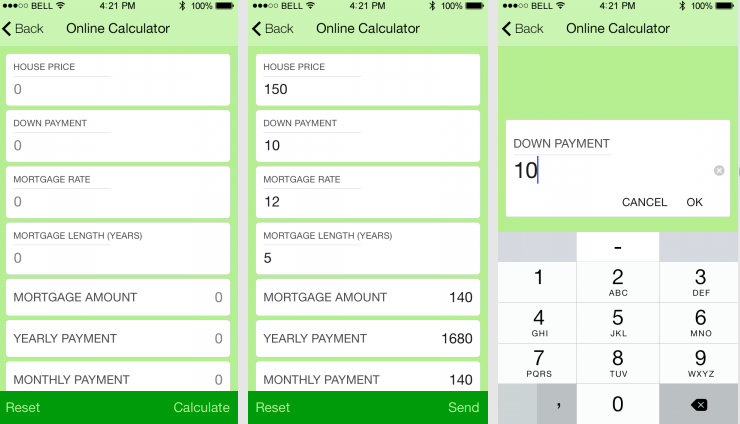

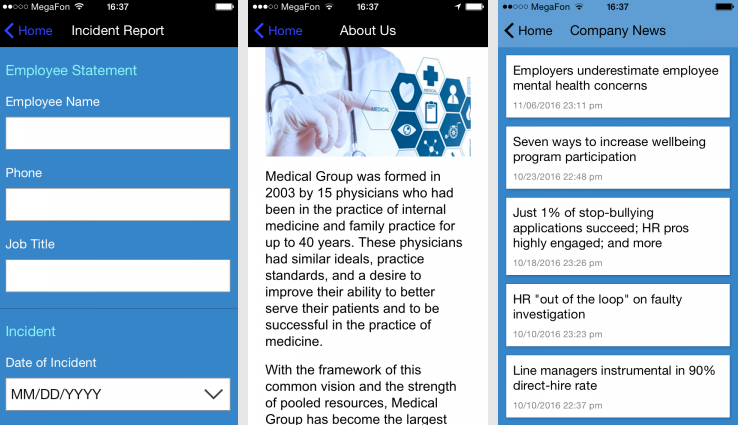

Create Your Own Adp Tax Payroll Hourly Paycheck Calculator App

Annual Salary Increases Industry Averages Key Factors Payscale

Complaint For Permanent Injunction And Other Equitable Relief

Free Direct Deposit Authorization Forms 22 Pdf Word Eforms

Symmetry Software Offers Dual Scenario Calculators To Aid In Comparing Take Home Pay For Varying Deductions And Benefits

Ruby Money Taxes Don T Need To Be Taxing

Flat Bonus Pay Calculator Flat Tax Rates Onpay

Create Your Own Adp Tax Payroll Hourly Paycheck Calculator App

Salary Payroll Tax And 401k Calculators Adp

Adp Paycheck Calculator Best Sale 56 Off Ilikepinga Com

Nondiscrimination Testing Adp And Acp Tests Dwc

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Colorado Paycheck Calculator Adp

Paycheck Calculator Take Home Pay Calculator

Employee Payroll University Of Colorado